Advantages and Disadvantages of Self-Funding

A self-funded plan has both advantages and disadvantages. Do you think your organization is ready to self-fund? Be careful and make sure you read the fine print or else you might be taking on more risk than you realize if you are not careful!

Self-funding Advantages – There are numerous well-documented advantages to self-funding for employers that manage risk well; including:

- Reduced insurance overhead costs. Carriers assess a risk charge for insured policies (approximately 2 percent annually), but self-insurance removes this charge.

- Reduced state premium taxes. Self-insured programs, unlike insured policies, are not subject to state premium taxes. The premium tax savings is about 2 to 3 percent of the premium dollar value.

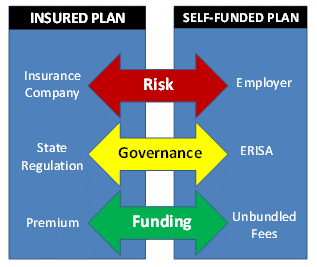

- Avoidance of state-mandated benefits. Self-insured plans are exempt from state insurance laws, subject only to Employment Retirement Income Security Act (ERISA) compliance.

- Choosing benefits services à la carte

- Flexibility in plan designs, administration and offered services

- Customizable stop-loss insurance to reduce the risk associated with high claims

- Improved cash flow. Self-insured employers do not have to pre-pay for coverage, and claims are paid as they become due.

- Additional cash flow if reserves are held in an interest-bearing account

Self-Funding Disadvantages – There are risks associated with self-funding that are sometimes overlooked. They include the following:

- Risk Assumption – Employer assumes risk between the normally anticipated claim level and Stop Loss Coverage level

- Claim Run Out Risk – Under a “paid” contract, the employer accepts risks for claims that have been incurred but not yet paid after the termination of the contract. This provision needs to be examined carefully to avoid future, unexpected liability

- Asset Exposure – Employer’s assets are exposed to any liability created by legal action against the self-funded plan

- Fiduciary Responsibility – Employer is responsible

Self-funding might be a great option to reduce cost; however, an experienced professional needs to be involved to assist in weighing risks. Let The Lank Group use our 25 plus years of experience to assist you in analyzing self-funding options. Call us today at 678-401-8230.